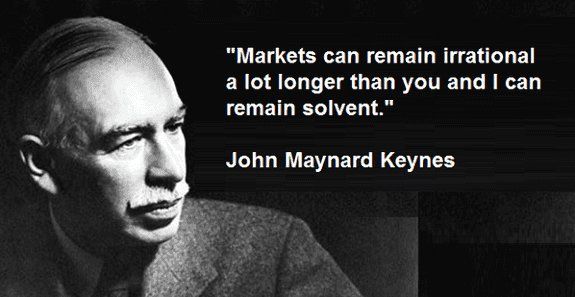

After observing 2020 – a year which is full of surprising ups and downs from the bottom of despair, where countless speculators have to cut losses because of margin debt, looking at their so called blue-chips VN30 stocks to plunge down the floor price for several “black days”, to the top of optimism – where countless pessimists tried to guess the top, “short” the VN30-Index futures, suffered serious losses and left the market, we suddenly remembered the beautiful adage from Sir John Maynard Keynes, the economist behind modern monetary theory and also a prominent individual investor:

“Market can remain irrational much longer than you and I can remain solvent” – John Maynard Keynes

Contact to invest with Golden River – a rare Vietnamese value investment manager: http://goldenriverinvestment.com/contact/

That is also the reason at Golden River, we have the discipline of never using margin debt to buy stocks, and never trying to short the market (VN30-Index futures), or specific stocks (which is still not legal in Vietnam) as an attempt to expect stock prices to go up/go down rapidly with rocket-high leverage, even when our data shows that the odds is 80% -90% in our favor.

Because only 10% -20% of the remaining unfavorable probability of an unfavorable surprise occurs due to the ever-present human irrationality in the stock market, including downside due to pessimism – like last March-2020 epidemic market panic, to the huge rise of stocks thanks to the unlimited optimism of the relentless bull market recently, it is enough for us to fall into bankruptcy if borrowing debt. margin to buy stocks, or vice versa – using leverage to “short” futures, which can create unlimited loss if irrational optimism continues!

Instead, at Golden River, we carefully analyze and decide to invest in small-cap and mid-cap companies that are neglected by the market, in essential industries, valuation 50% cheaper than the index average, which offers consistent high return on capital (ROE) and a steady cash dividend policy, ensures a satisfactory level of return even in the worst case scenario.

On the investment path for decades to come, we are not trying to chase the crowd to get a quick return for a few quarters and then risk losing everything with a 5% -10% chance of the bad luck appearing, but more importantly, we rather uphold our discipline and a our conservative investment philosophy – which is capable of scaling in the long term, delivering above-average compounding interests and a good night sleep for our clients .. .