According to VNExpress, more than 36,600 individual investors opened securities accounts in April, the highest since the VN-Index peaked 1,200 points (Mar-2018) to date

Contact to invest with Golden River – Vietnamese rare value investment manager: http://goldenriverinvestment.com/contact/

According to the announcement of Vietnam Securities Depository (VSD), the number of securities trading accounts of investors as of March 31 was 2,435,566 accounts, an increase of 32,140 accounts compared to the end of February, 2020 in spite of Covid-19.

Accordingly, the number of new accounts opened in March was the highest in the past 2 years, only behind an increase of 41,505 accounts in March 2018. The difference in March 2018 was when the stock market peaked in history, while the current period of the market has experienced a plunge since the beginning of 2020.

However, in April, the number of newly opened securities trading accounts recorded more than 36,720 accounts, most of which were newly opened by individual investors. This figure is higher than the previous month of nearly 5,000 accounts, setting a new record after VN-Index reached 1,200 points two years ago.

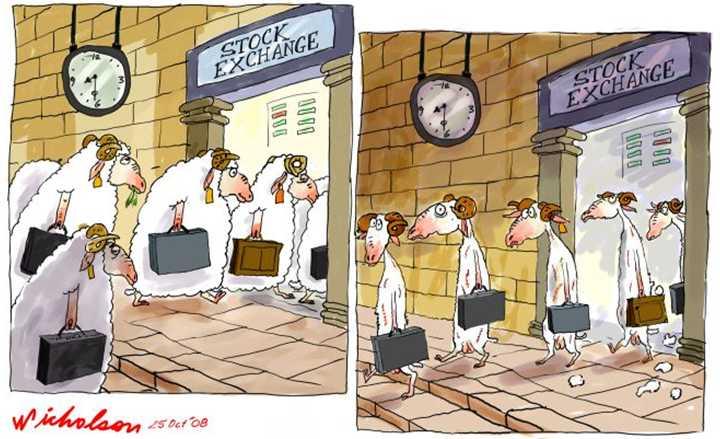

This may be good news in the long term, helping to change Vietnamese investment habits that only focus on savings/buying real estate, thus helping to develop the stock market as an indispensable investment channel for every household similar to the current developed countries such as US, Europe, Japan, Korea, China or Singapore. However, if the new joining individuals do not have the mindset to buy common stocks as a part of the business with long-term vision, yet instead they go on the path of wild speculation, margin leveraged, expecting to “get-rich-quick” without any business fundamentals understanding or any other risk management methods in the way that 90% of all market participants are doing now, this is a big risk for the market in general and their own assets in particular amid the fear of missing out (FOMO) when the Covid-19 epidemic seemed to pass away, and the price of almost every stock returned to their expensive levels as before…