Many legendary investors, newspapers, and experts say that the current remarkable growth of NASDAQ is not the same as the “dot-com bubble” of 1999-2000, but when we look outside the group of Trillion Dollars Big 5 FAAMG (Facebook, Apple, Amazon, Microsoft, Google), it looks like that history doesn’t seem to repeat itself, but it does rhyme – borrowing Mr. Mark Twain words…

Contact to invest with Golden River – a rare Vietnamese value investment manager: http://goldenriverinvestment.com/contact/

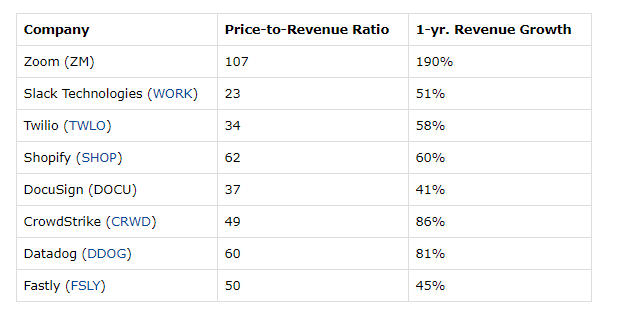

P/S (price-to-sales) valuation is calculated by using a formula that divides the company’s market capitalization by its total revenue. Usually, investors often value companies based on earnings (P/E), book value (P/B) or cash flow (P/CF) because this represents business earnings power, time to payback their principal as well as asset values. But for technology companies, most of them are in the growth phase and are losing money (burning cash), so from the dot-com bubble period 1999-2000, Wall Street came up with the P/S valuation method to rationalize their endless optimism. However, the current technology industry’s average P/S valuation typically ranges between 3.0x and 7.5x, because revenue can never be the bottom line for shareholders, given their gross margins under huge competition, their uncertain monetization methods, and also numerous types of expenses such as employee salaries, R&D, taxes, interests, etc

One picture more than a thousand words, we shall see the current P/S valuation of NASDAQ hottest stocks after the pandemic:

Souce: The Felder Report, figures calculated Oct-2020

Yes that’s right, we do not have trouble with our eyes! Zoom Video Communications (NASDAQ: ZM), the hottest stock during the epidemic with an online video streaming platform for meetings and presentations, has a valuation of up to 107 times revenue (!) despite that the company still losing money due to inability to make money effectively on the platform, plus enormous competition pressure from other platforms such as Google Meet, Microsoft Teams, Skype Video, etc The same situation is happening with countless other emerging technology stocks with a market capitalization of between $10 billion and $100 billion on NASDAQ: including Shopify (ecommerce), Datadog (data analytics) and a number of other international stocks such as Sea Limited (ecommerce & gaming), Pinduoduo (ecommerce). Assuming the above companies can pay 100% of their revenue to shareholders, investors still need at least 20-100 years to pay back their principal!

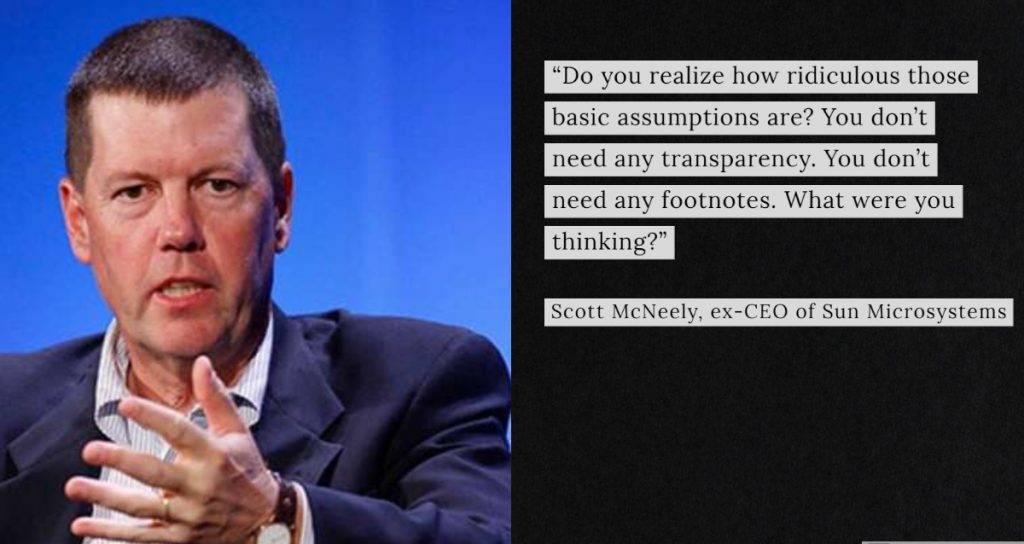

To demonstrate the insanity with this valuation, we borrow the perfect words from Scott McNealy, former CEO of Sun Microsystems, one of the most popular stocks in the 1999-2000 dot-com bubble, which was conducted a few years later in a Bloomberg interview about the peak company’s valuation of 10x revenue, or 10x P/S, let’s imagine how low it was compared to the current valuation of the group in the table above:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate.

Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?“

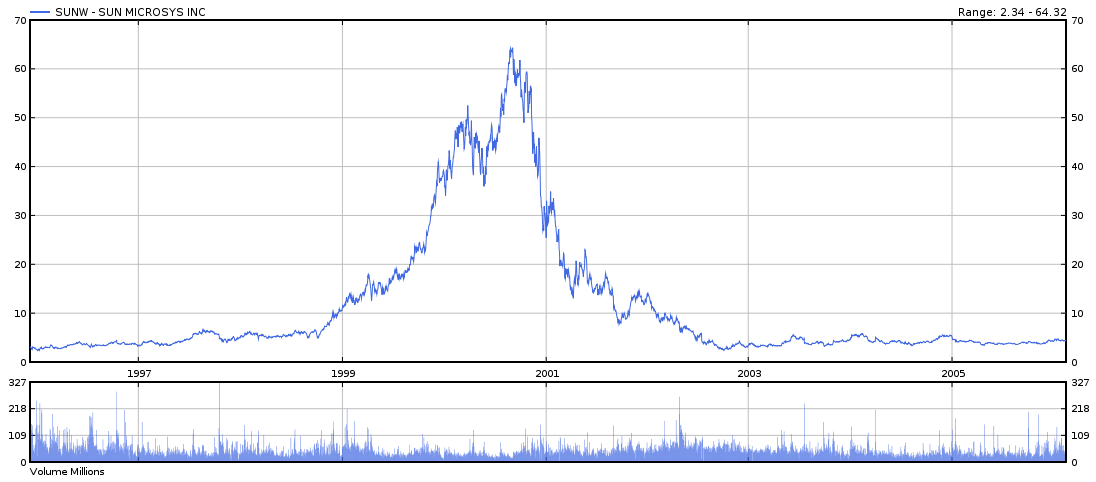

Not really surprised, after the peak of late 2000, Sun Microsystems shares fell -90% just a short time later (picture above), wiping out all of the capital from speculators with excess “optimistic” character more than the essential prudence needed in the investment field.

In conclusion, given the valuation of these emerging tech companies, we don’t find it uncommon for the NASDAQ to continue to cross one historical peak after another, but we believe that sooner or later, they cannot avoid the inevitable force of “intrinsic value gravity”, the higher they go above their fair value, the more painful their subsequent fall will be, as we have already seen in the particular case of Sun Microsystems, or the history of dot-com bubble crash in 2000!