Excerpt from the transcript “The Psychology of Human Misjudgement” – a legendary talk at Harvard University – by Mr. Charlie Munger in 1995

Contact to invest with Golden River – a rare Vietnamese value investment manager: http://goldenriverinvestment.com/contact/

@Mr. Charlie Munger: “The happiness that is brought to a human being when he makes $10 compared to the pain of losing $10 is not exactly the same thing. Loss always affects one’s psychology more strongly than the reward one receives. Furthermore, if a person was just as close to getting something he wanted so bad, and then lost it in the last minute, he would react as if he has had it long ago and been robbed so tragically.

Having seen this kind of mentality, I combine both types: loss-of-possessed and loss-of-almost-possessed into this form of mentality.

- Loss-of-possessed:

We human beings often become miserable and think small when we misjudge the problem, under the wrong circumstances. We tend to compare simple, close-up situations instead of the big picture that actually affects us on a larger angle. For example, a person with 10 million dollars in a stock account will naturally get extremely angry – almost a full day loss – if he loses $100 in a $200 wallet, or someone rips he off the same amount.

We Mungers family used to raise a gentle, obedient dog. There is only one way for it to bite me back: that is when I try to get the bone which it already put in his mouth. If you try to do it yourselves, every dog will bite you back. It would be foolish for a dog, the most loyal of its kind, to bite his master; but the dog was irresistible, mainly due to the deprival super-reaction tendency made it impossible not to become so stupid.

In everyday life, we also see how common this is when farmers scramble over each tree, every yard of their lands for fear of the neighbor taking over some of its border. Those who lost their lovers to others suddenly become jealous, then blindly revenge – leaving many tragic stories as we already knew.

The commitment & consistency bias also causes many businesses to fail. The most classic form of the falling down is when a business owner gradually sells/uses up all of his good assets, to save a hopelessly bad business segment. Here, one of the best solutions to this extreme stupidity is the early learning of poker skills. In Poker, cutting losses – no matter how painful, in order to limit the larger losses by the decision to stop playing – is a very important skill in business, or even in daily life. The best entrepreneurs understand the value of sunk cost and opportunity cost when facing with a clearly bad situation.

- Loss-of-almost-possessed:

The gambling types in casio that are the most addictive are those that produce a series of “near misses” that cause players to be triggered by the psychological trap of reacting to being deprived of something that is almost owned!

Slot machine creators are extremely cunning when they exploit this human weakness. Those electronic machines were programmed to produce 80% to 90% of the results in a meaningless “a little near there” format like BAR-BAR-LEMON. However, this thing attracts and increases the playability of fools who think they are about to reach the magic reward (?!)

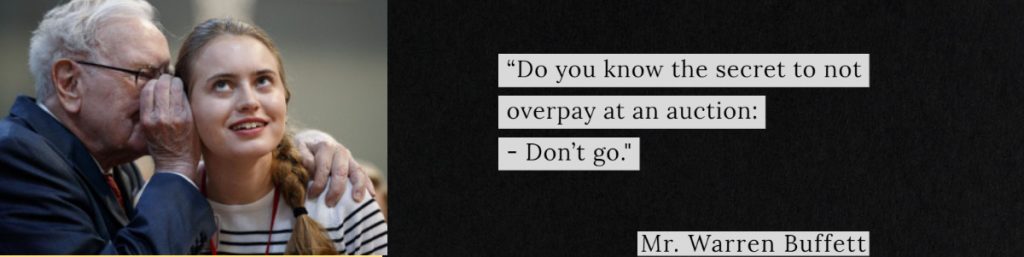

This “Deprival” mentality even caused us more damage in outcry auctions. The social proof psychology is the reason that makes us believe that the auction call final price is justified, and the tendency to fear of missing out (FOMO) gives us a strong incentive to foolishly push prices up. The best solution that Buffett has ever shared, to avoid auctioning high prices is, interestingly, this simple: Don’t go.”

(quoted & translated from The Golden Newsletter Vietnam: https://newslettervietnam.com/chuyen-ngan-tam-ly-phan-ung-manh-me-khi-bi-tuoc-doat-cua-loai-nguoi-ngai-munger/)